Apollo Strategic Growth Capital

About

At Redding Ridge, our largest business consists of acting as a collateral manager for CLO transactions and related warehouse facilities, and as a holder of majority equity investments in the US and European CLOs we manage.

We also have a growing partnership investing and staking strategy through which we can acquire minority economic interests in third-party managers while providing balance sheet and consultative support.

Redding Ridge was established and seeded by Apollo Global Management in 2016 in response to risk retention regulations. Redding serves as the risk retention holder in all of our EU CLOs, and we have the ability to satisfy EU risk retention for US deals to capitalize on strategic EU debt investors.

clo management

Redding Ridge combines significant CLO management and structuring expertise, with a vast network of industry contacts and investor relationships. We are supported by top-tier credit research, trading and risk management to strategically position our funds for success. We also believe our perpetual capital base provides a competitive advantage in allowing us to maximize CLO arbitrage opportunities.

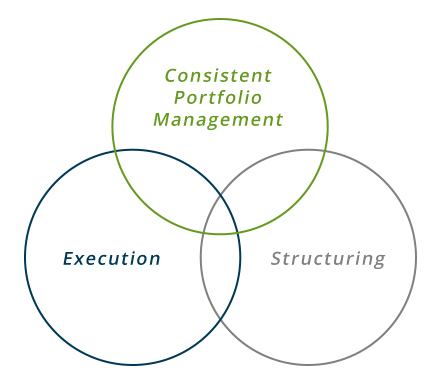

Our CLO philosophy centers on consistent portfolio management, execution and structuring. We believe this generates the best performance for all investors.

Redding Ridge has a strong focus on execution and structuring in addition to consistent portfolio management. We believe this generates the best performance for all investors.

Consistent Portfolio Management: Maintain a disciplined investing approach through all markets. We invest on a bottoms-up basis, building high-quality portfolios derived from a deep understanding of each underlying asset.

Execution: Strategic and selective on timing when ramping assets and issuing a deal in order to create attractive investment vehicles.

Structuring: Each deal is structured to fit our credit investment style and both current and evolving credit market trends.

Redding Ridge has a strong focus on execution and structuring in addition to portfolio management. We believe this generates the best performance for all investors.

Market Accessibility and Experience

Redding Ridge Asset Management has been formed with key features allowing for successful execution and management of CLOs:

Warehousing

Long-tenor warehousing

Access

Significant access to assets, deal flow, management teams, industry insights and the investment banking community

Experience

CLO Management Experience with a dedicated team of professionals with an average of 22 years of experience in leveraged loans and CLOs

Systems

Access to systems supporting trading & operations, as well as monitoring of CLO compliance tests

PARTNERSHIP INVESTMENTS

As part of our diversified strategy, Redding Ridge is increasingly active in partnership investing with third-party credit managers. Our flexible approach allows for a wide range of investment types, including minority GP equity, revenue sharing arrangements, convertible working capital loans and other economic interests.

Manager selection is key. We look to partner with those who share in our disciplined investment philosophy and can further benefit from our scaled platform via balance sheet and debt capital support, structuring advice and other consultative services. Our objective is to make strategic investments where Redding Ridge can drive additional value and create win-win outcomes for our partners.

Redding Ridge has entered into contracts with Apollo Global Management to provide:

Apollo Global Management provides corporate and operational services to Redding Ridge, including human resources, trade operations/settlements, administration, vendor contracts and information technology

Employee arrangements with Apollo Global Management pursuant to which certain key U.S. and European credit professionals are shared

Apollo provides both initial and ongoing credit research and analytics for Collateral Obligations being considered for or held by CLOs managed by Redding Ridge

Our People

Investment Professionals

Mr. Moroney serves as a Chief Executive Officer of Redding Ridge. Mr. Moroney joined Apollo in 2008 and concurrently serves as a Senior Partner and Co-Head of the Global Corporate Credit business. Prior to joining Apollo, Mr. Moroney was with Aladdin Capital Management where he served as the Senior Managing Director of its Leveraged Loan Group. Mr. Moroney's investment management career spans 26 years, with experience at various leading financial services firms including Merrill Lynch Investment Managers and MetLife Insurance. Mr. Moroney graduated from Rutgers University with a B.S. in Ceramic Engineering and serves on the Board of Overseers of the Rutgers Foundation. He is a Chartered Financial Analyst and a member of the NYSSA.

Mr. Leas serves as a Managing Director and member of the Board of Directors of Redding Ridge. He is also a Senior Partner at Apollo and currently serves as Head of Global Structured Finance and ABS and Co-Head of Asset Backed Finance. Prior to joining Apollo in 2009, Mr. Leas was a Director at Barclays Capital with primary responsibility for the loan structuring and advisory team. Prior to Barclays Capital, he was an associate at Weil, Gotshal & Manges LLP, primarily focusing on asset backed securities, CDOs and credit derivatives. Mr. Leas is the former Chairman of the Board of Directors of the Make-A-Wish Foundation of Metro New York and Western New York. Mr. Leas graduated cum laude from the University of Maryland with a B.A. in History and received his J.D., cum laude, from Georgetown University Law Center.

Mr. Patel is a member

of the Credit Investment

Committees for Redding Ridge UK. He joined Apollo in

2008 and concurrently serves as a portfolio manager in

the Corporate Credit Group based in London. Mr. Patel

has 19 years of experience in the financial markets

and serves as lead Portfolio Manager on Apollo and

Redding Ridge CLOs. Mr. Patel has been Apollo’s senior

trader in London since he joined and has played an

integral role in sourcing assets for all of Apollo’s

European CLOs since their inception in 2013. He was

central in rebuilding the European Credit platform

across distressed and liquid products. Prior to

working at Apollo, Mr. Patel was a trader at Morgan

Stanley in London from 2006 to 2008, trading high

yield bonds, loans, credit default swaps (CDS) and

loan CDS (LCDS). In 1999 he joined the Barclays

graduate program and worked on the market risk desk in

New York, and from 2001 to 2006, traded high yield

bonds and CDS for the European Credit team at Barclays

Capital in London. He graduated from Kings College

London (University of London) with a BSc (Hons). He is

also a Chartered Financial Analyst holder (CFA) from

the CFA Institute.

Mr. Huntington serves as Head of Structuring and Advisory at Redding Ridge. Prior joining Redding Ridge at its inception in 2016, Mr. Huntington was a Principal in Apollo's Corporate Structured Credit Group. Prior to joining Apollo, Mr. Huntington was a Director in the CLO Structuring & Origination Group at Bank of America Merrill Lynch. Since joining Apollo, he has transacted on over $150 billion of CLOs, ABS, corporate debt and other asset-backed financings across 180+ transactions. Mr. Huntington graduated from The University of Virginia with a B.S. in Chemical Engineering and received his M.B.A. from The College of William & Mary, where he graduated Beta Gamma Sigma.

Ms. Ravani joined Redding Ridge in 2022 as a Managing Director. Prior to joining Redding Ridge, Ms. Ravani was a Director in the CLO Primary group at Citigroup Global Markets Inc. While at Citigroup Ms. Ravani was responsible for origination, structuring and syndication of US CLOs and was involved in over 200 transactions, representing over $100bn volume over a 15-year timeframe. Ms. Ravani graduated from the Massachusetts Institute of Technology with dual B.S. degrees in Mathematics and Economics.

Mr. D’Angelo is a Portfolio Manager and Managing Director of the Management Company. Prior to joining Redding Ridge, Mr. D’Angelo was a Senior Portfolio Manager and Managing Director at Pretium Credit Management LLC in New York where he managed a portfolio of high yield and distressed bank loans for six CLOs, one Total Return Fund and one public Mutual Fund, representing over $2.5 billion in total assets. Prior to joining Pretium, Mr. D'Angelo was the Senior Portfolio Manager for the High Yield Loan Group at Aladdin. He was a key man and primary portfolio manager on all of Aladdin's CLO transactions and total return loan funds, which totaled over $3.5 billion in assets. Prior to joining Aladdin, Mr. D'Angelo was a Director of Investments at Harbinger Capital Partners, focusing on distressed credits across several industries. Before Harbinger, he was a Vice President, Senior Credit Analyst at ING Capital Advisors, LLC. Mr. D'Angelo also worked in the leverage banking divisions at CIBC World Markets, Royal Bank of Canada and Credit Lyonnais. Previously, he spent five years at The Chase Manhattan Bank in the Real Estate and Emerging Markets restructuring groups. Mr. D'Angelo received his MBA from New York University, Leonard Stern School of Business and BS from SUNY Albany.

Mr. Frangione is a Portfolio Manager and Managing Director of the Management Company. Prior to joining Redding Ridge, Mr. Frangione was a Senior Trader and Managing Director at Alcentra LLC in New York where he was responsible for all loan trading for CLOs, SMAs, Multi-Asset Funds and public Mutual Funds representing over $10 billion in assets. Prior to Alcentra, Mr. Frangione worked in the Asset Recovery Group at BNY Mellon as a credit analyst and trader helping to wind down an over $2.0 billion portfolio of non-strategic distressed and performing term loans and revolvers. At BNY Mellon, Mr. Frangione also worked in its Capital Markets group as a credit analyst as part of a team that started a loan platform with over $1.5 billion in assets invested in two CLOs, an SMA and an internal proprietary fund. Mr. Frangione received his MBA from Georgetown University, McDonough School of Business and BA in Economics from Bucknell University.

Mr. Farr is a Portfolio Manager and Managing Director. Prior to joining Redding Ridge, Mr. Farr was a founding partner and Senior Portfolio Manager for Gulf Stream Asset Management in Charlotte, N.C. where he managed $2.8 billion in syndicated bank loan assets across seven CLOs. Prior to joining Gulf Stream, Mr. Farr was a senior research analyst at Steele Creek Investment Management, an asset management firm with $3.0 billion of assets. From 2005 to 2011, Mr. Farr was a research analyst with Gulf Stream covering technology, business services and distressed credit portfolios. Mr. Farr worked as a distressed portfolio manager for Patriarch Partners from 2003 until 2005. Mr. Farr began his career with Wachovia spending ten years working in the bank’s credit underwriting and capital markets divisions. Mr. Farr received his A.B. in Economics from Davidson College.

Mr. Caruso is a Portfolio Manager and Managing Director. Prior to joining Redding Ridge, Mr. Caruso was a founding partner and Head of Trading at Gulf Stream Asset Management in Charlotte, N.C. where he was responsible for all trading activity across seven CLO transactions and $2.8bn of AUM. Prior to Gulf Stream, Mr. Caruso was a Fixed Income Trader at TIAA where he was responsible for trading leveraged loans and bonds across multiple mandates which totaled more than $20B in assets across a diverse set of portfolios that included insurance accounts, mutual funds, and CLOs. Prior to TIAA, Mr. Caruso was a Senior Financial Analyst at Baker & Taylor. Mr. Caruso began his career at Gulf Stream Asset Management where he served as a Research Associate. Mr. Caruso graduated cum laude from Radford University with a B.B.A. in Finance and Economics.

Mr. Leach is a member

of the Credit Investment

Committees for Redding Ridge UK. He joined Apollo in

2015 and concurrently serves as a portfolio manager in

the Corporate Credit Group based in London. Prior to

joining Apollo, Mr. Leach spent eight years at Cheyne

Capital, initially working on the Total Return Credit

Fund, and latterly as Portfolio Manager of the Cheyne

Long Short Credit Fund, which he managed since late

2011. Mr. Leach graduated from the London School of

Economics with a first class honours degree in

Economics and Government.

Mr. Patel serves as a Deputy Portfolio Manager for the European CLOs. Prior to Redding Ridge, Mr. Patel spent ten years at Oaktree Capital Management, most recently as Senior Vice President in the Performing Credit team. Prior to Oaktree, Mr. Patel worked at BNP Paribas in the Leveraged Finance division and Lloyds Banking Group in the Restructuring Group. Mr. Patel graduated from the University of Bristol with a first class honors degree in Economics and Finance. He is also a Chartered Financial Analyst.

Mr. Shearman joined Redding Ridge in 2018 and is currently a Managing Director, Mr. Shearman worked from 2013 to 2018 as an Associate at Dechert LLP, where he primarily focused on structured finance transactions, including broadly syndicated and middle market CLOs, credit warehouse facilities and risk-retention related financing vehicles. He has been involved in the structuring and execution of over $36 billion of CLOs, CLO Refinancings, CLO Resets, Aviation and Corporate ABS across more than 65 transactions. Mr. Shearman graduated, with distinction, from the Ross School of Business at the University of Michigan with a B.B.A. (concentration in finance) and received his J.D. from Brooklyn Law School, where he was named a Harvey F. Wachsman Endowed Scholar graduating with a certificate in business law, also with distinction.

Mr. Paniwozik is Partner and Global Head of Structured Credit Investing at Apollo. Prior to joining in 2015, Mr. Paniwozik was a Managing Director and the Senior Product Strategist for U.S. Corporate Credit at Napier Park Global Capital. He began his career in credit structuring at Credit Suisse First Boston. Mr. Paniwozik received a BA in Economics, with honors, from the University of Chicago.

Business Professionals

Ms. Hester is the Chief Legal Officer of the Collateral Manager. Ms. Kristin Hester is Managing Director & Senior Counsel, Permanent Capital Vehicles at Apollo. Ms. Hester is also General Counsel for Apollo Debt Solutions BDC, Apollo Investment Corporation, Apollo Senior Floating Rate Fund Inc. and Apollo Tactical Income Fund Inc., and Chief Legal Officer for Apollo Diversified Credit Fund. Prior to joining Apollo in 2015, Ms. Hester was associated with the law firms of Dechert LLP from 2009-2015 and Clifford Chance US LLP from 2006-2009. In each case, she primarily advised U.S. registered investment companies, their investment advisers and boards of directors on various matters under the Investment Company Act of 1940. Ms. Hester received her JD from Duke University School of Law and graduated cum laude from Bucknell University with a BS in Business Administration.

Ms. Sundel is the Chief Compliance Officer of Redding Ridge. Ms. Sundel joined Apollo in 2021 as a Managing Director, Senior Compliance Officer based in New York. She most recently worked at Sculptor Capital Management (f/k/a Och-Ziff), where she served as Regulatory Counsel & Senior Compliance Officer. Prior to Sculptor, Ms. Sundel was a Securities Compliance Examiner at the SEC, focusing on their Investment Adviser Program. Earlier in her career, she worked as a Litigation Associate for both Bernstein Litowitz Berger & Grossmann and Labaton Sucharow. Ms. Sundel earned her law degree from New York Law School and graduated with a Bachelor of Arts in International Relations from Franklin University Switzerland.

Mr. Marra serves as Chief Financial Officer and Chief Operating Officer of Redding Ridge. Prior to joining Redding Ridge in 2024, Mr. Marra was a Partner, CFO, and Chief Compliance Officer at 26North Partners LP. Prior to that, Mr. Marra spent 13 years at Apollo Global Management, where he held key leadership roles, including Managing Director in Credit Finance and CFO/Treasurer of the Apollo Senior Floating Rate and Apollo Tactical Income Funds (2014-2021). His earlier experience includes positions at Lehman Brothers Inc., Stone Tower Debt Advisors, and PricewaterhouseCoopers LLP. Mr. Marra holds a B.S. in Accounting and Finance from Syracuse University.

Contact

Redding Ridge Asset Management

9 West 57th Street , 17th Floor , New

York, NY 10019

Phone:

877 CLO RRAM / Email:

info@rram.com